Never has there been a time where so much information is readily available than now. Not only is more information available it is available faster than ever before. Photos don’t need a week to develop; you don’t have to wait until morning to read the newspaper to find out what happened in the world yesterday. Instant news and results are the new normal.

Never has there been a time where so much information is readily available than now. Not only is more information available it is available faster than ever before. Photos don’t need a week to develop; you don’t have to wait until morning to read the newspaper to find out what happened in the world yesterday. Instant news and results are the new normal.

Business and investing is no exception. There are dedicated business news channels, websites, blogs, podcasts, books, magazines, newsletters, twitter feeds, seminars and pundits, all offering their opinions (this blog included!). Mass media headlines sway the market, stocks prices and the sentiment of investors. Analyst upgrades and downgrades trigger knee-jerk reactions, compounded by high frequency trading, stop losses, short positions and the heard mentality.

But access to all this information should make investing easier. As an investor, you consider oil prices are down, the Canadian dollar is down – consumer staples should do well. You can buy iShares S&P/TSX Capped Consumer Staples Index ETF (TSX:XST). Sound logic, wrong perspective. Here is the problem – you missed the boat. With a P/E (price to earnings) ratio of 24, now is not the time to buy consumer staples, but to consider selling them. In 2011, the TSX Consumer Staple index was 13.9 (historical P/E ratio of the TSX is around 15). This is what I call shortermism. Shortermism, is a natural progression of today’s society in general and is the companion of a get-rich-quick mindset.

Let’s look at this from a different perspective. Stocks prices follow supply and demand principles. When demand increases, prices go up. When demand decreases, prices go down. You can buy the latest smart phone the day it becomes available to market but you will pay a premium. You can buy the same phone a year later, when demand has gone down for much less. Same phone, same functions, huge savings. Your retirement fund doesn’t need the newest phone, or the hottest stock. You need to make money, not show off that you own the latest trends.

Stocks are shares in a company (physical assets, people, intellectual property etc.). I don’t think the intrinsic value of a company changes as much as the stock prices change. Here lies the opportunity.

1) Invest in the Long Term

Long term isn’t 6 months or a year from now. I invest with a 5, 10 or 25 year horizon. I won’t be 65 for more than 20 years, so why wouldn’t I invest for the future? I can’t tell you what will happen tomorrow on the markets, but I believe the price for useful materials that have limited supply will ultimately go up (real estate, oil, uranium, metals, etc.). Invest in areas (via ETFs) or specific stocks that you believe have long term potential. Look at the big picture, ignore the noise.

2) Look for Value

Find companies and ETFs that are trading below their average P/E ratio and/or have huge potential. I like companies that are profitable and pay a sustainable dividend, even when times are rough. You don’t need to do complicated technical analysis. Quickly look at long term trends, history and averages.

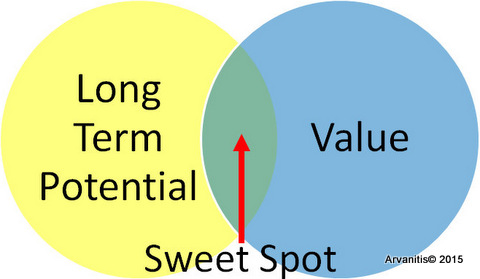

3) Find the Sweet Spot

When you can marry long term potential and value, you have hit the sweet spot.

Last October I bought Agrium for $94 (TSX:AGU) . I had been watching the stock price for many months. Good long term prospects – check, good value – check, profitable – check, pays dividend – check. I bought ½ my intended position. I was planning to buy the other half if it dropped to $90. It didn’t. Agrium is up about 50% in the last 5 months. I was lucky it did well in the short term, but I still hold it for the long term.

I like (and have a long position in) PrairieSky Royalty (TSX:PSK). I recently bought it below the original IPO price. Good long term prospects – check, good value – check, profitable – check, pays dividend – check. I am not worried about this investment. Another investment that I have held longer but has not appreciated is Cameco Corp (TSX:CCO). I’m not sure what will happen in the next year or two, but Cameco is still profitable, it pays a dividend and I believe they are very well positioned for the future.

If you look at long term trends and buy stocks/ETFs when they are cheap – you can forget analysts’ recommendations, market fluctuations, short term trends along with the rest of the noise and have peace of mind. You might just beat “the market” while you are it…

Be happy, live long and prosper! Farewell Leonard Nimoy and thank you.